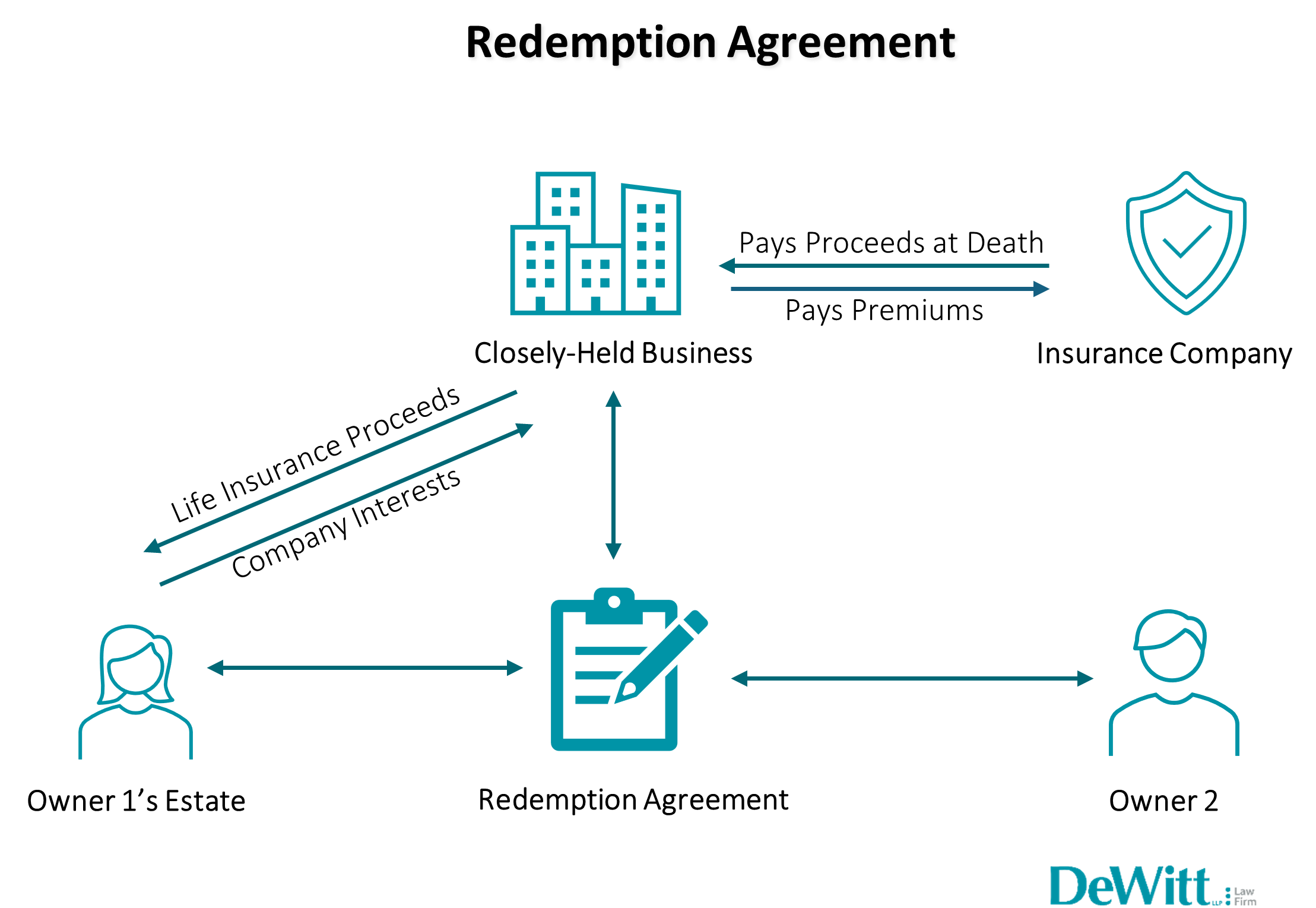

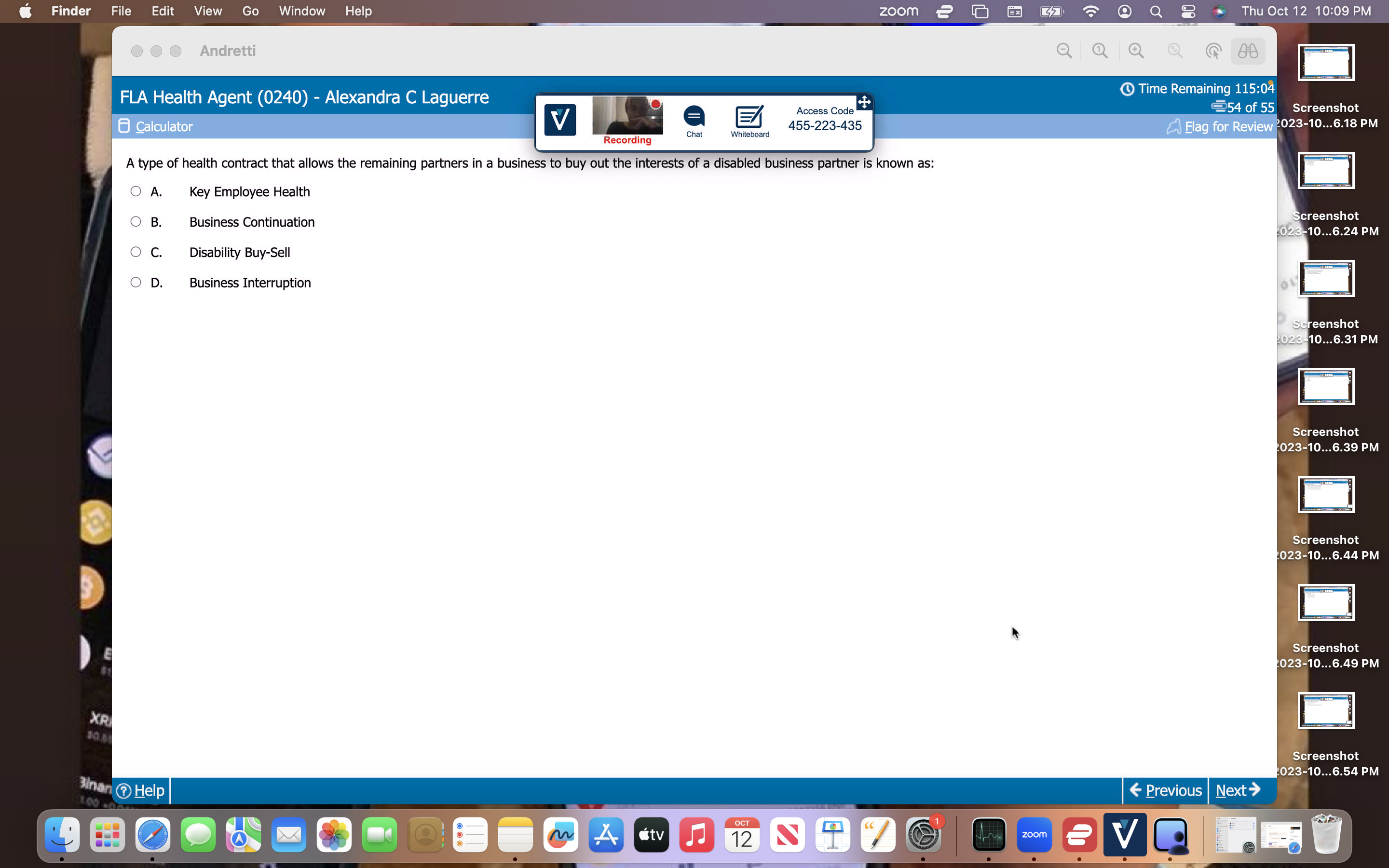

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Nicholas On General Hospital Today

- Is Tara Palmeri Related To Jennifer Palmeri

- Racist Jokes To Tell Your Friends

- Married July 1 2012 Yanni Wife Linda Evans

- Lynda Mclaughlin Sean Hannity Show

- Pick Up Times For Fedex

- Setlists Fm

- 1977 1 Dollar Bill Value

- Average Annual Rainfall Los Angeles

- Espn Picks Final Four

- Remote Job Indeed

- Buick Ispot Tv

- Facebook Marketplace Maysville

- Kiser Funeral Home Greeneville Tn

- Buzzfeed Fall Quizzes

Trending Keywords

- Job Employment Indeed

- Wgn Anchors

- Anaheim Police Activity Today

- Nanny Faye Chrisley Passed Away

- Nicholas On General Hospital Today

- Is Tara Palmeri Related To Jennifer Palmeri

- Racist Jokes To Tell Your Friends

- Married July 1 2012 Yanni Wife Linda Evans

- Lynda Mclaughlin Sean Hannity Show

- Pick Up Times For Fedex

Recent Search

- Verizon Fios Log

- Realtor Bahamas

- Law Enforcement Radio Frequencies

- Teaching Pastor Job Openings

- Home Care Aide Jobs

- Famous Old Actresses Still Alive

- Entry Level Software Developer Jobs No Experience Remote

- Crossdresser In Public

- Brennan Funeral Home Obituaries Topeka Ks

- Barstool Sports Twitter

- Isaias Torres First 48

- Charleston Sc Murder

- Job Employment Indeed

- Wgn Anchors

- Anaheim Police Activity Today

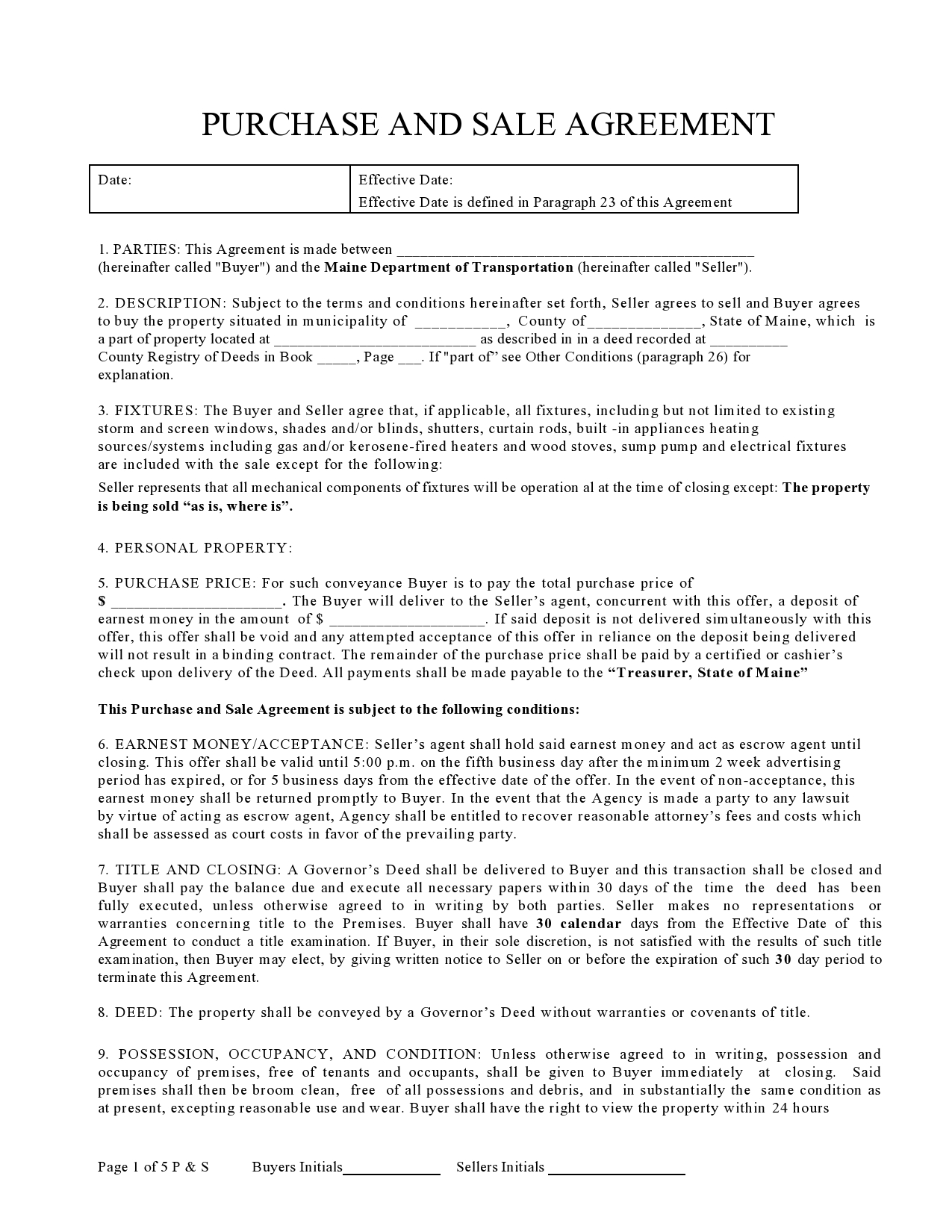

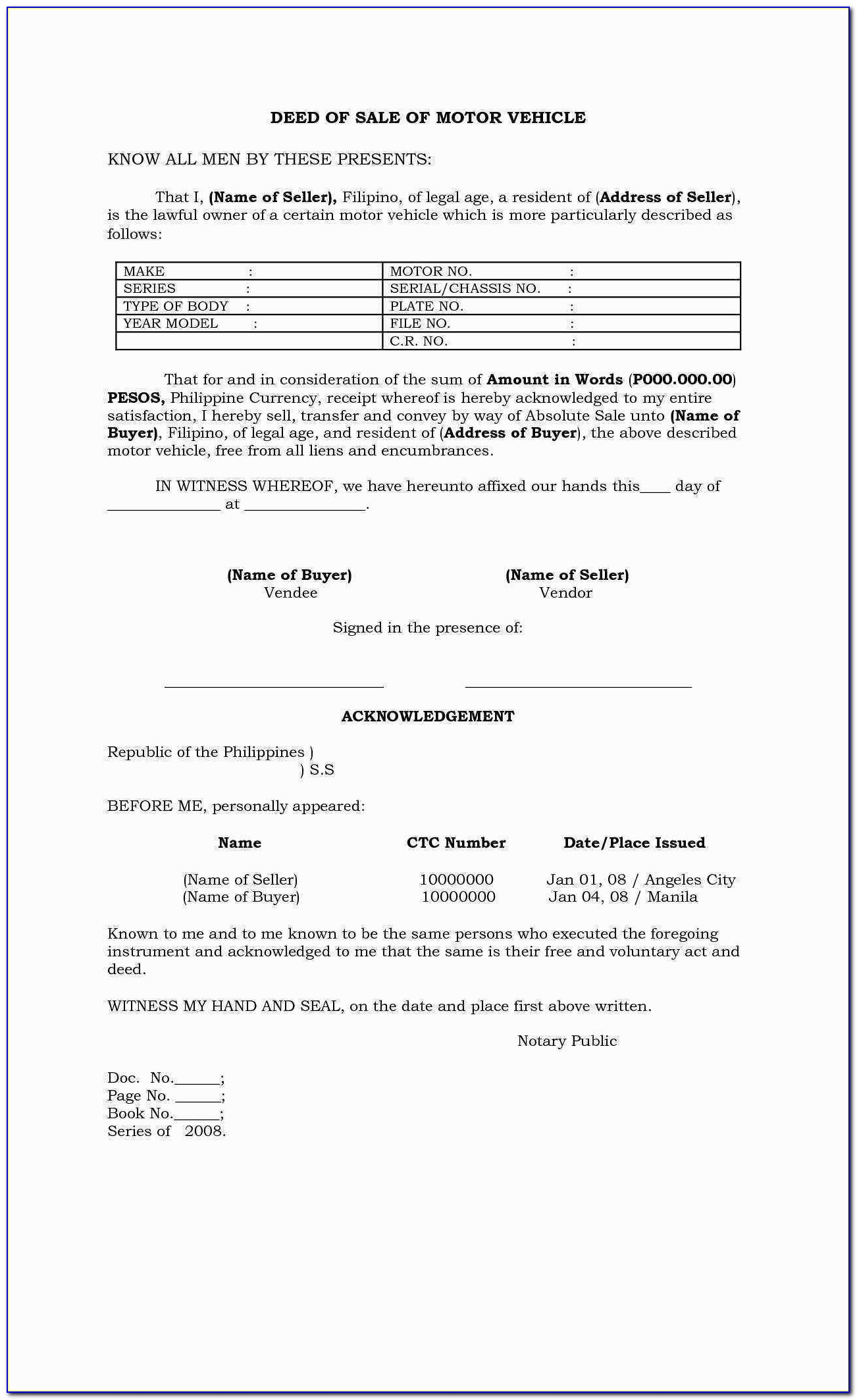

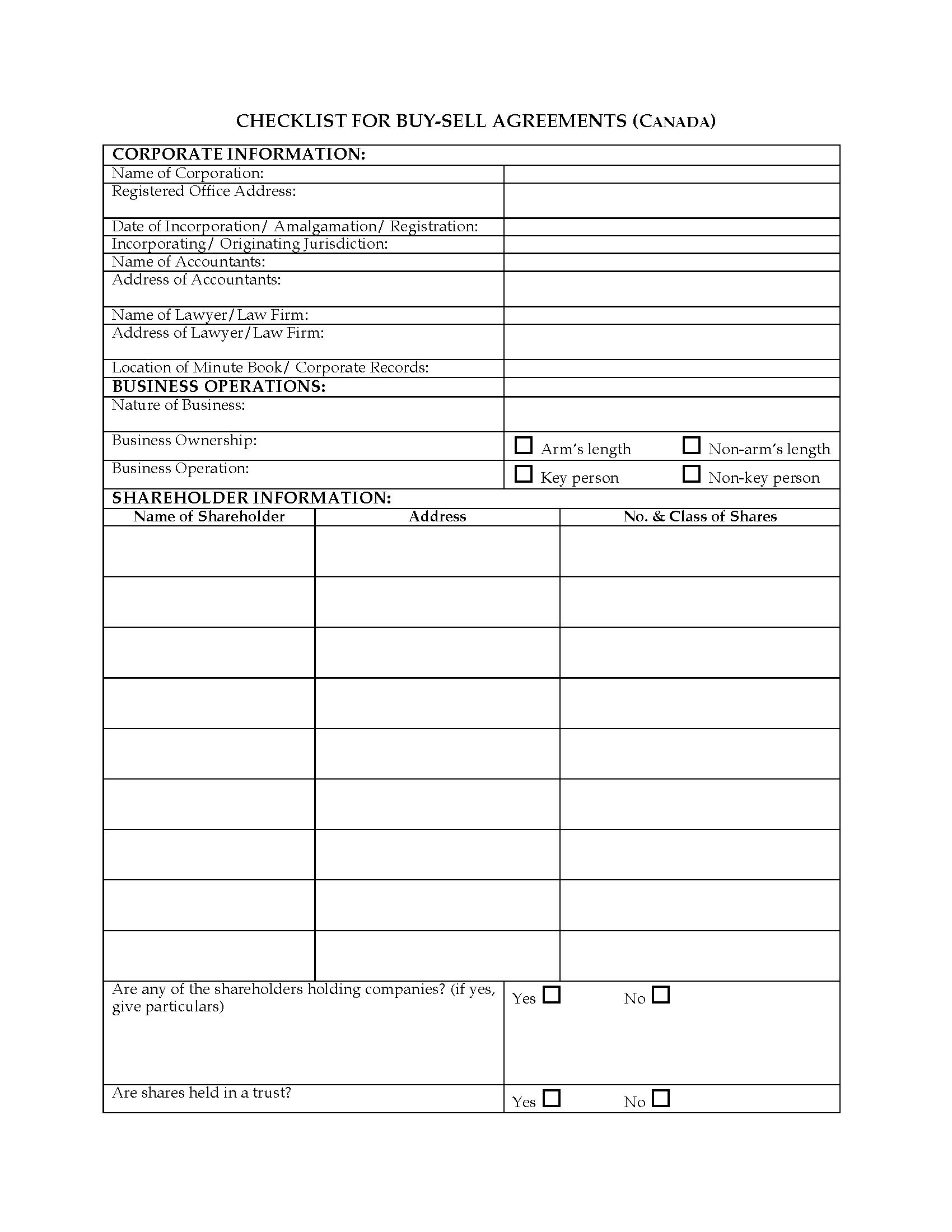

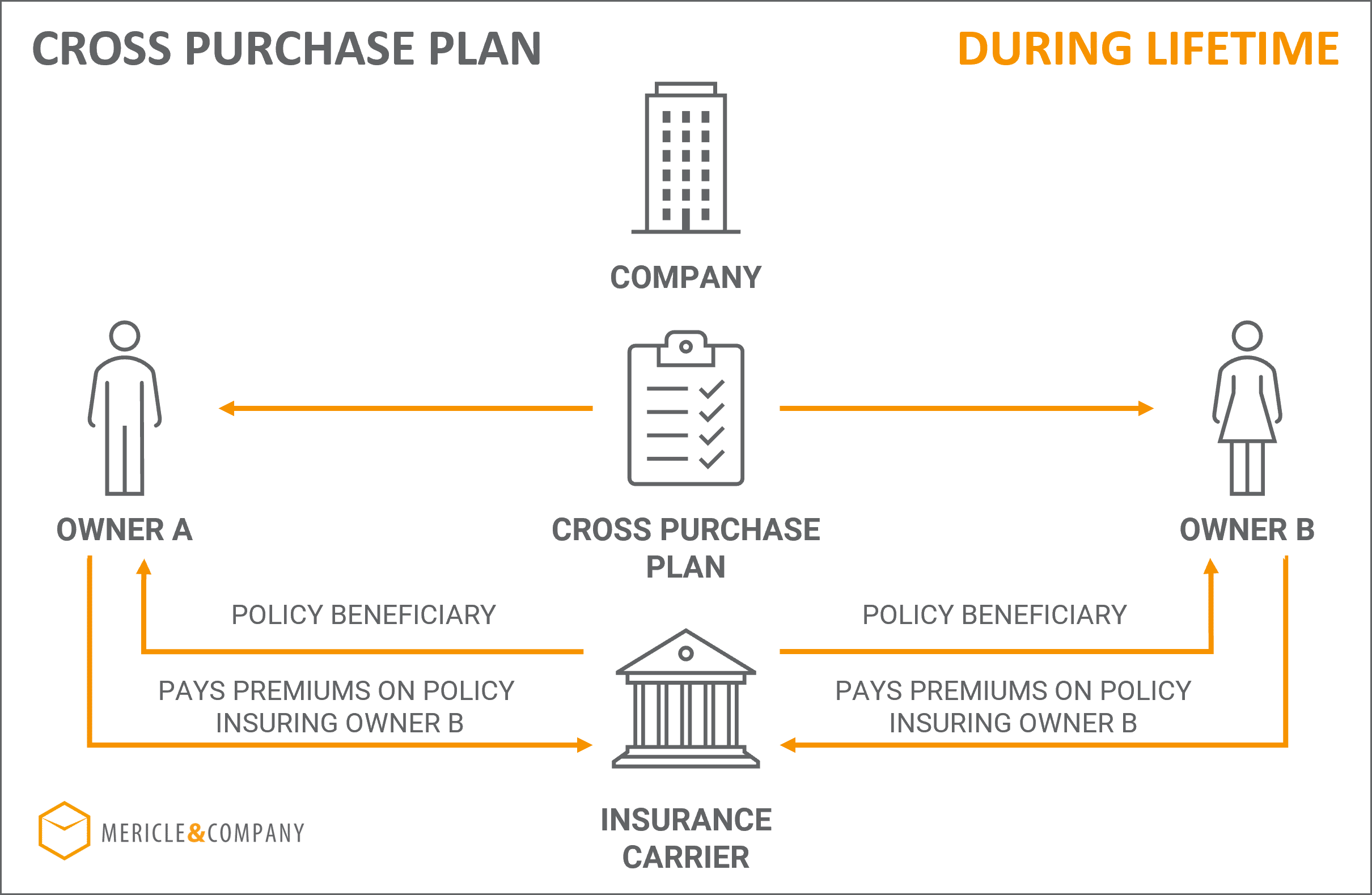

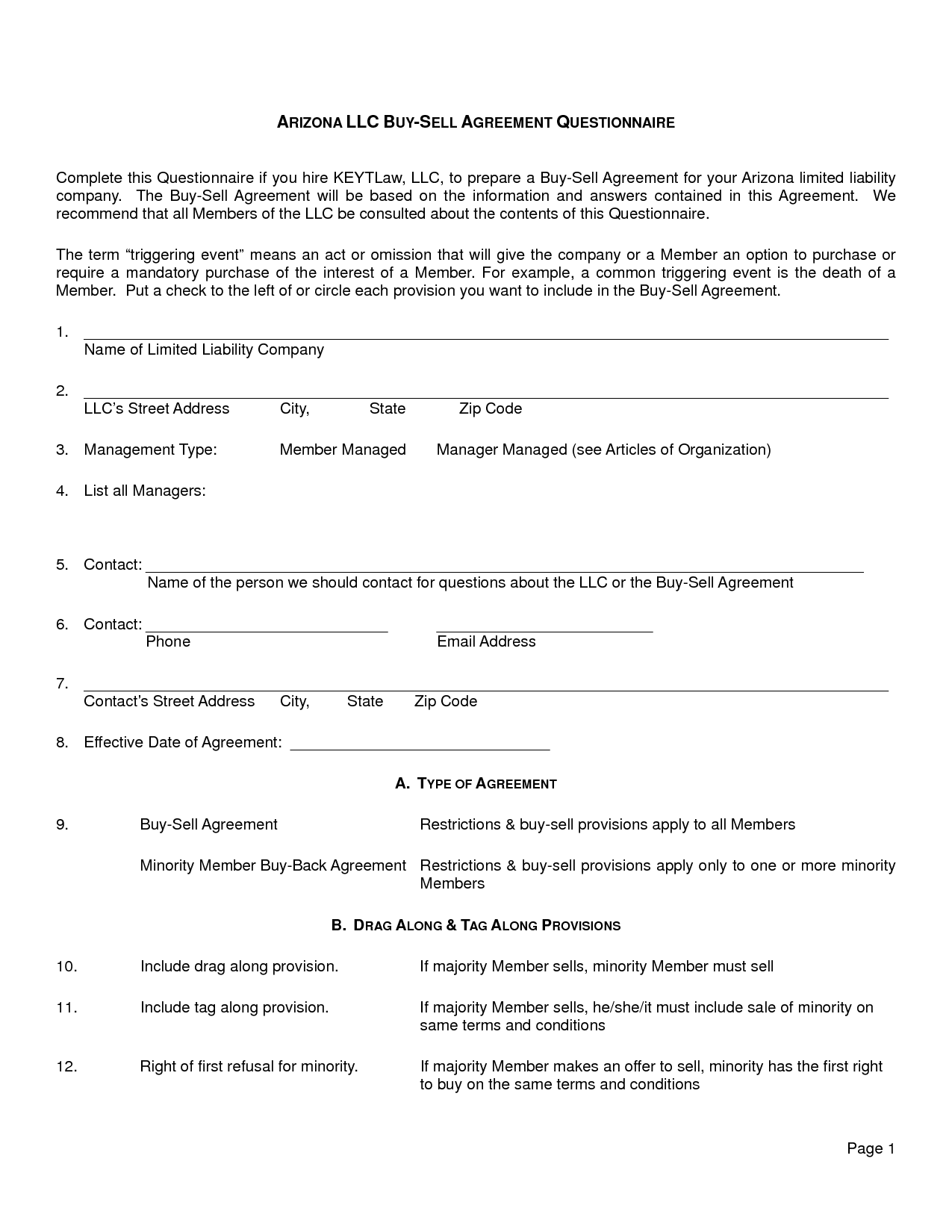

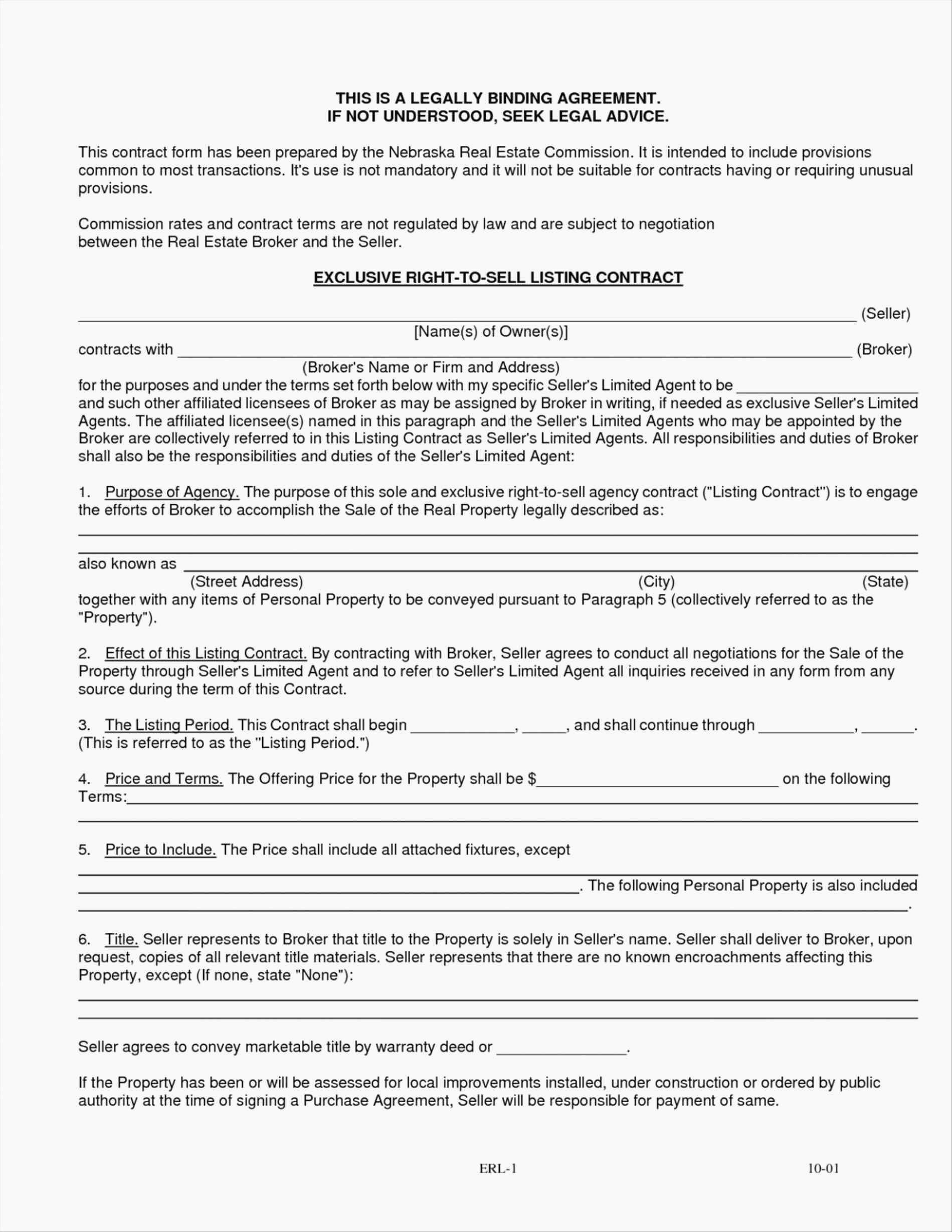

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)