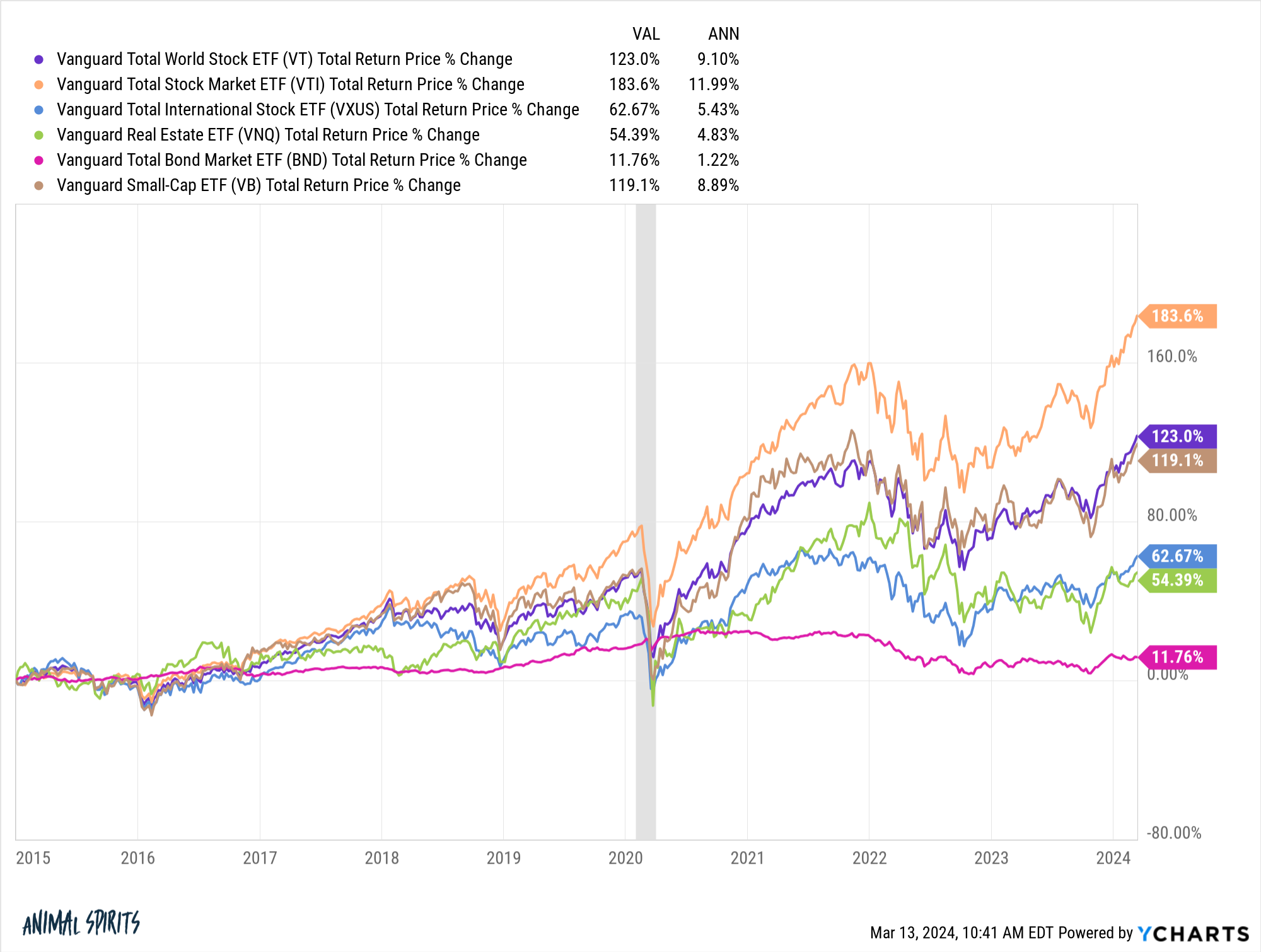

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Related Posts

Recent Post

- Ups Package Handler Apply

- Sunday Theodore Wikipedia

- Usps Paid Holidays

- Academy Awards Youtube

- Saco Maine Police Scanner

- Rutgers Pre Business Courses

- Police To Citizen Muskegon Michigan

- Marion Mugshots Com

- Entrepreneurs Who Want To Open A Franchise Quizlet

- Fhp Accident Report

- Ky3 Springfield Mo News

- Stepmomson

- Sub Contractors Needed

- Joe Concha Net Worth

- Animal Manure Quizlet

Trending Keywords

Recent Search

- Dignity Memorial Online Obituary

- North Kingstown Ri Police Log

- Checkpoints In San Bernardino County

- What Job Pays 300 An Hour

- Entry Level Jobs Paying 25 An Hour

- Marion County Florida Breaking News

- Accident On Us 10 Michigan Today

- Kid Rock Calls Ambulance

- It Operator Jobs

- Vertex Gemini 8th House

- Vore Edit

- Autopsy Photos Of Gabriel Fernandez

- Tennessean Obituaries Complete Listing

- Chevy Tahoe Forum

- Purdue Writing Lab

_14.jpg)