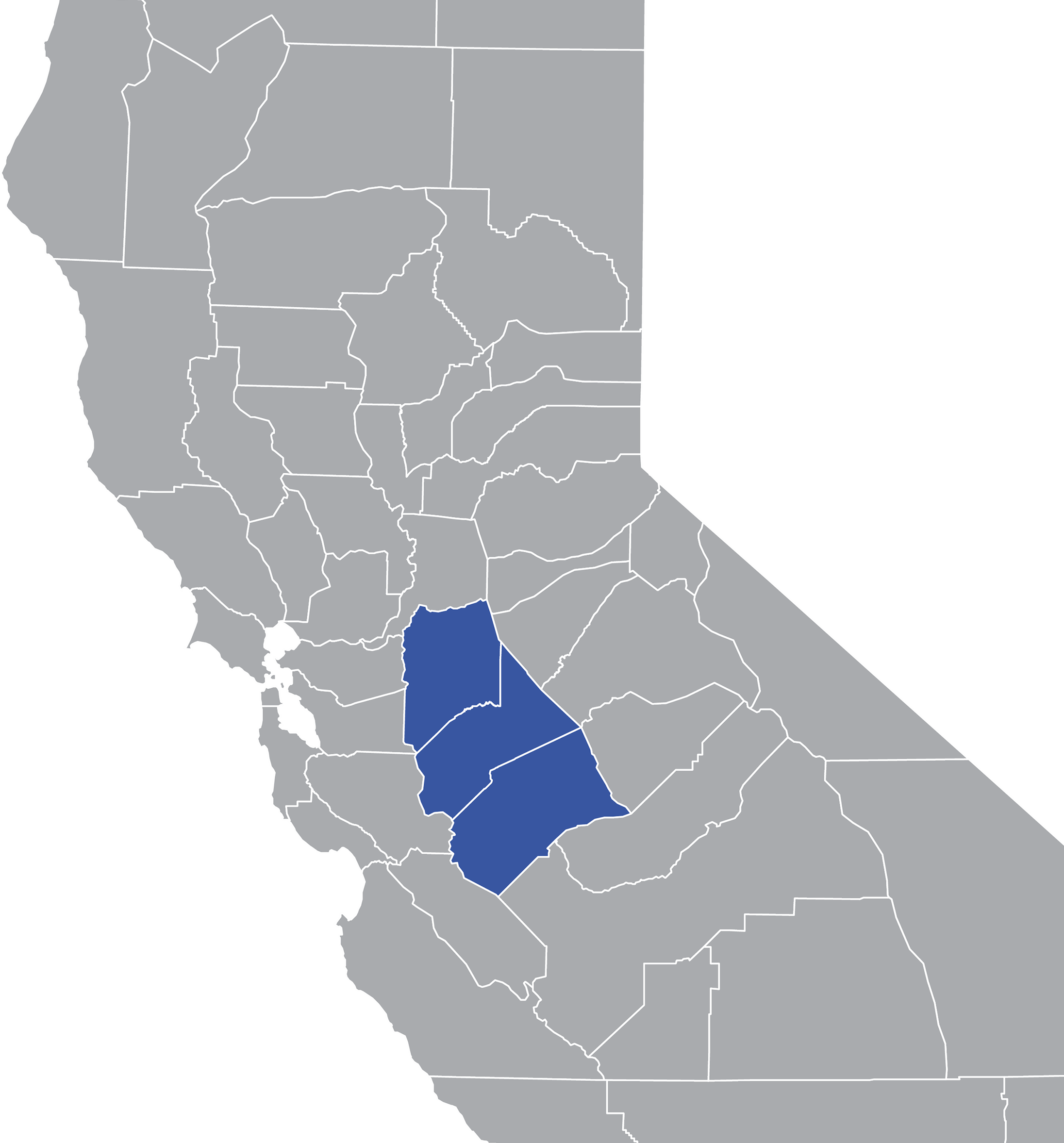

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Carports Lumberton Tx

- Primary Come Follow Me 2023 Lesson Helps

- Beck And Jade Break Up

- Lowes Stone Gravel

- Bathroom Place Kendall

- Progress Index Obituaries Petersburg Va

- West Funeral Home Obituaries Carlsbad Nm

- Purolatorboss

- The Vanity Store Ca

- Hax Washington Post

- Bridget Linton Espn Cleveland

- 716 W 4th Ave

- Dollar Tree Cylinder Candle Holders

- Aldis Nearby

- Waterproof Shower Wall Panels Menards

Trending Keywords

Recent Search

- St Charles 18 Cinema Showtimes

- Scams On Mercari

- Owensboro Daviess County Obituaries

- Qvc Order Status

- Capital One Swe Intern Interview

- Sako L691 Action

- Cody Enterprise Obituaries

- How To Make 300 A Day With Doordash

- Obituaries Ruidoso Nm

- Petco Walk In

- Kobalt Small Truck Tool Box

- Ups Job Near Me

- Live Music And Food Atlanta

- Northwestern Newspaper Oshkosh

- Female Small Hawaiian Tattoos

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)