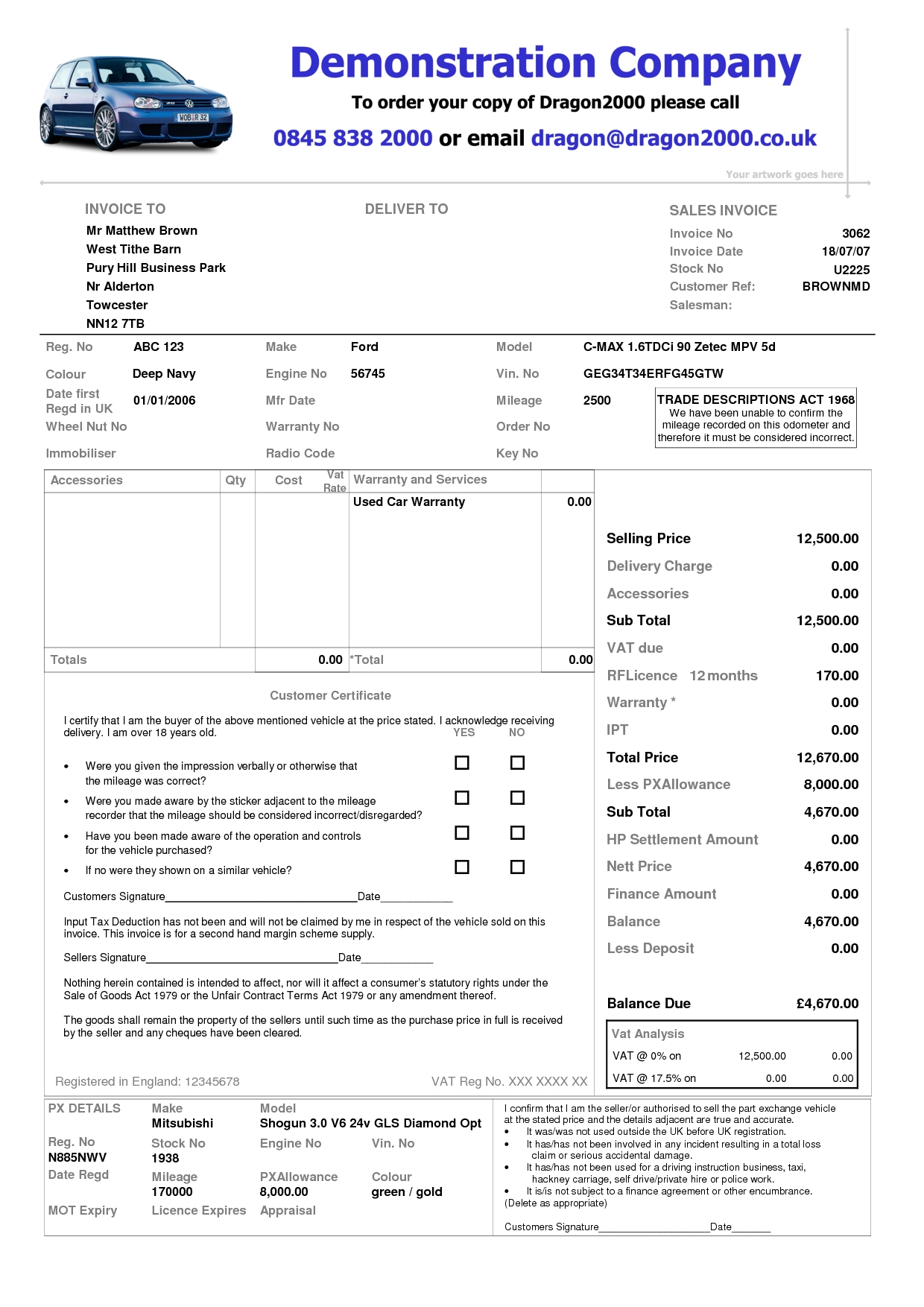

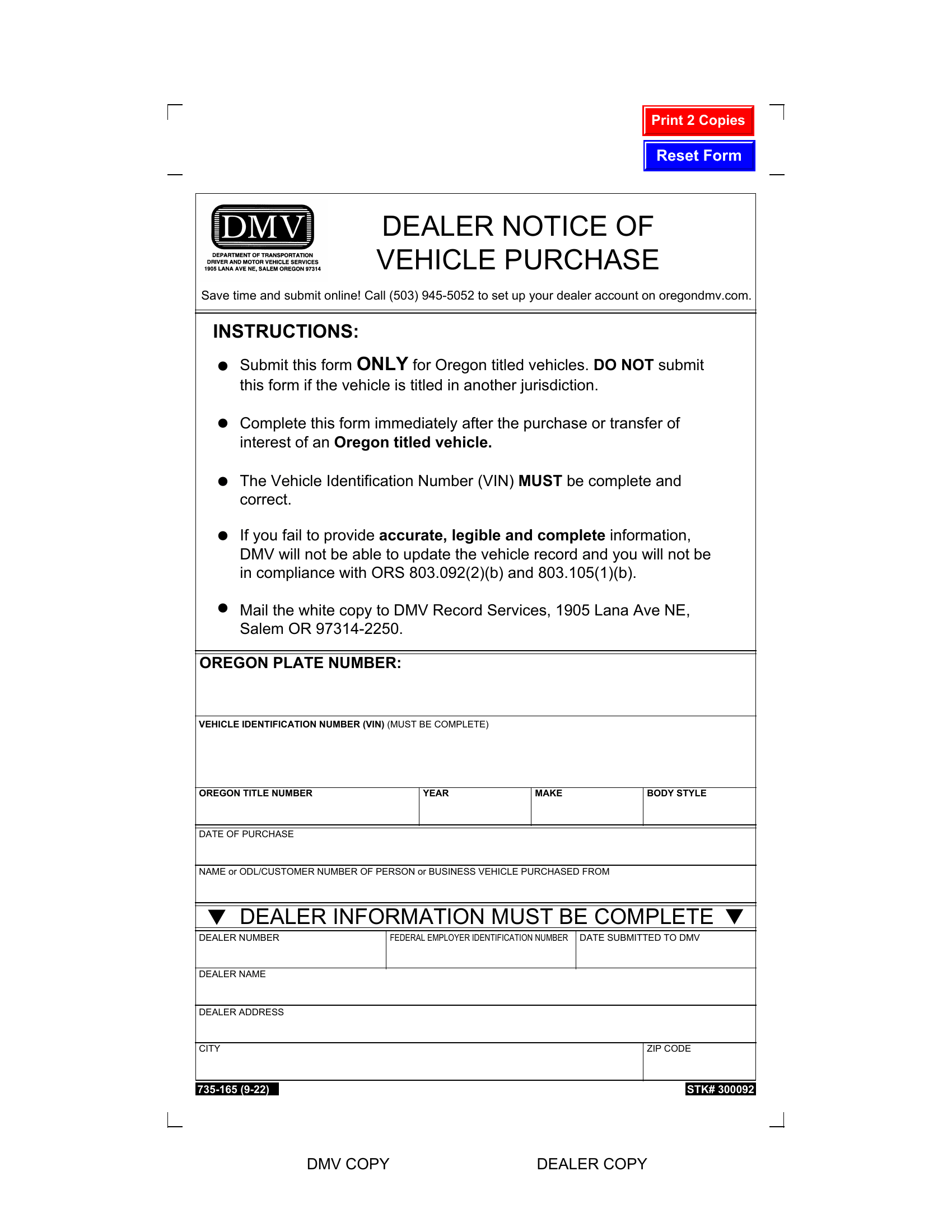

Weba motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. The lessor is responsible for the tax, and it is paid when the vehicle is registered at the local. Webjan 26, 2012 · texas car tax is going to vary because of city, county and state taxes. Each city has their own rates of taxation, as do the counties as well. The best way to figure. Webtexas sales tax on car purchases: Vehicles purchases are some of the largest sales commonly made in texas, which means that they can lead to a hefty sales tax bill. Webusing the texas auto tax calculator is simple: Input basic information about your vehicle, such as make, model, year, and purchase price. Webmotor vehicle sales tax is the purchaser’s responsibility. If the seller is not a texas licensed dealer, the purchaser is responsible for titling and registering the vehicle, as.

Related Posts

Recent Post

- Crockett County Tn Mugshots

- Wawa Fuel Associate

- Cancer Weekly Horoscope 2024

- I 40 Amarillo Road Conditions Today

- Abc Wjla

- Spectrum Network Map

- Benson County Jail Roster

- Circle K Stores Jobs

- Shooting Lawrenceville

- Ok On Demand Court Records

- Arrest Logs Santa Cruz

- Enid Buzz Enid Ok

- First Round Mock Draft

- County Mugshots

- Victor Tangermann

Trending Keywords

Recent Search

- Bush Set List

- Cbs News Minnesota

- Olivia Dunne Editing Photos

- Desoto County Recent Arrests

- What Happened To Amanda From The Dr Phil Show

- What Is The Correct Order Of Steps For Handwashing Quizlet

- Coldplay Setlists

- Mid Morning Wcco

- George Strait Concert Youtube

- John And Micheal Miller

- Coming Goings On Days Of Our Lives

- Carl Johnson Wikipedia

- Criminal Mugshots

- Bold Matsuri Jacksonville

- Christian County Jail Inmate Search