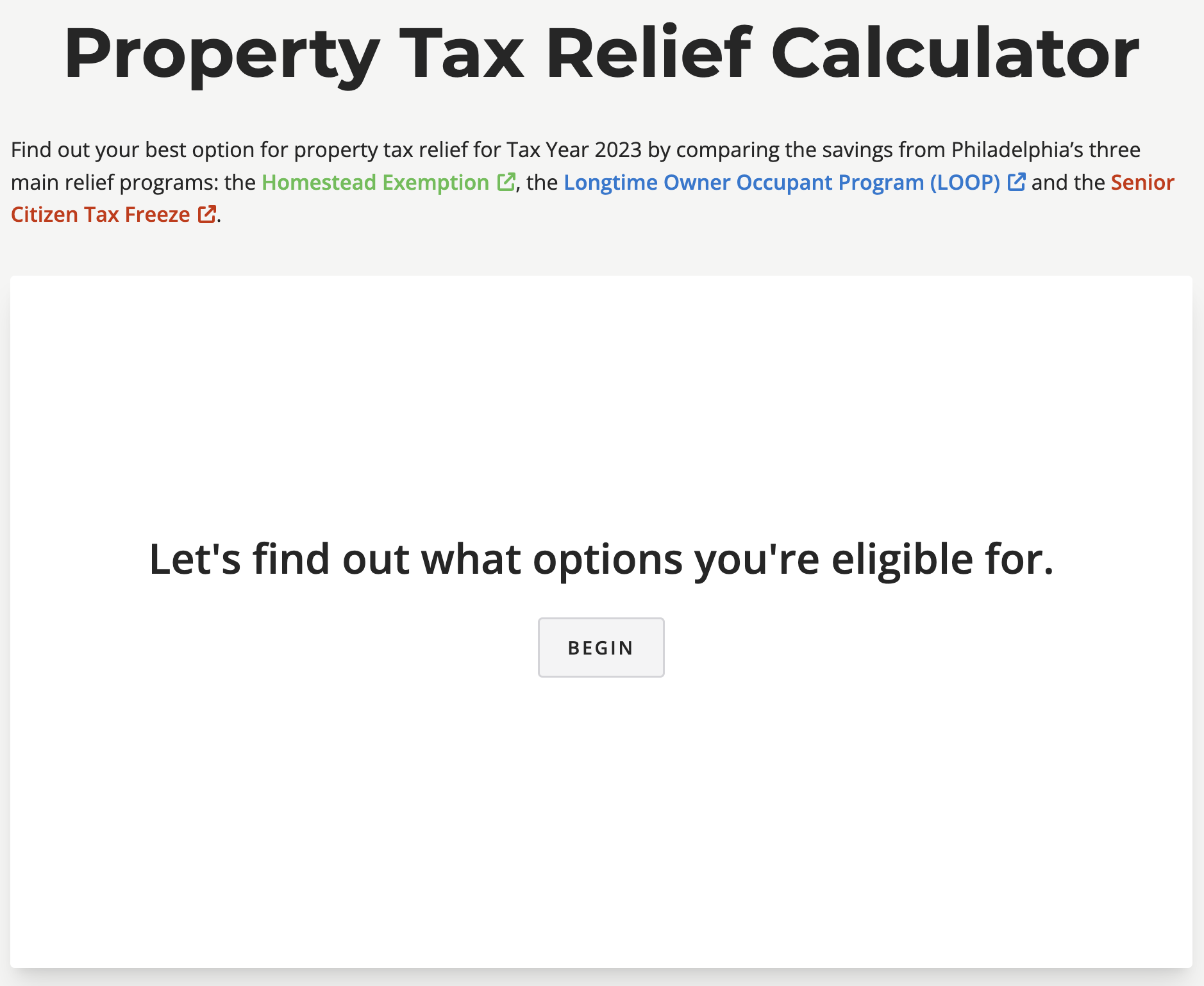

Webdec 27, 2023 · how to calculate your doordash tax impact. We'll talk about the basic steps you can take to identify the tax impact from your doordash (and other gig economy). Calculate your 1099 taxes on your doordash income. This includes freelancers and business owners. Webjan 2, 2024 · if you earn $600 or more as a doordash driver in a given year, you’re responsible for filing and paying doordash taxes. This easy guide will explain everything. Webwhen your taxes are calculated at the end of the tax season is the first time they will technically know if you owe penalties or not. If your tax liability is over $1,000 and you. Weba 1099 tax calculator takes into account your income, expenses, and deductions to determine your tax liability. By inputting your 1099 income, along with any business.

Tax Calculator For Doordash

Door DashTax Info

Door DashTax 1092

1099 TaxForm From Door Dash

Where Is Door DashTax Form

Door DashTax Template

Door Dash Spreadsheet Template With Tax Deduction

Door DashTax Stamernt

Door DashTax Summary

Door DashTax Statement

Door DashTax Documents

Door Dash DriverTax

How To Get Door Dash Tax Form

Door Dash Pay StubsTax